The business leaders of the national trade organizations related to information technology sector (ICT) sector expressed gratitude and thanks on behalf of the entrepreneurs of the entire ICT to the Prime Minister Sheikh Hasina for extending the tax exemption period of the ICT sector by three years in the budget of the FY 2024-25 announced by the government. Besides, they said policy support is needed now to achieve self-reliance in this sector.

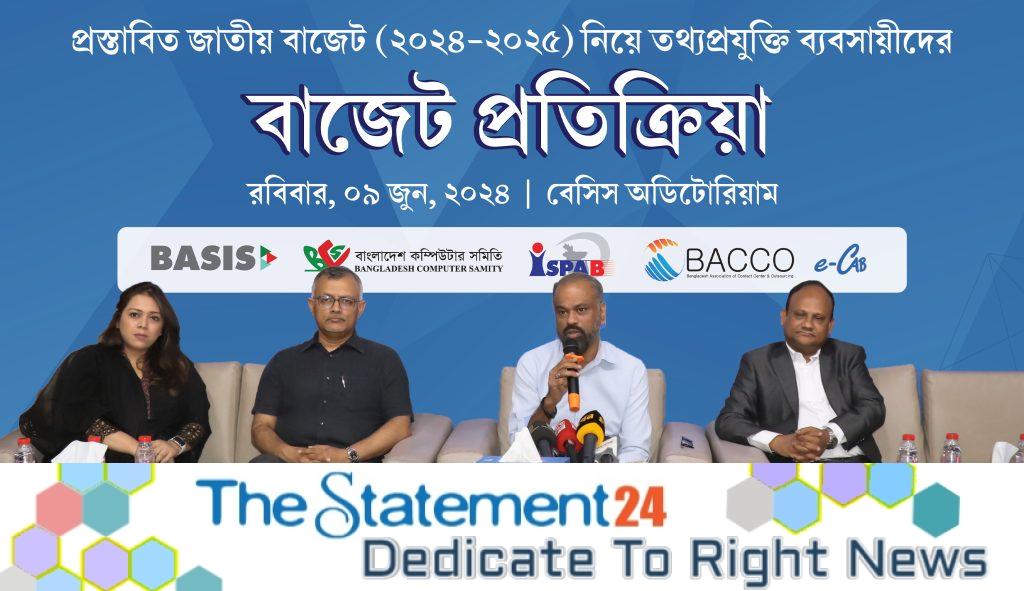

The Bangladesh Association of Software and Information Services (BASIS), Bangladesh Association of Contact Center & Outsourcing (BACCO), Internet Service Provider Association of Bangladesh (ISPAB) and E-Commerce Association of Bangladesh (E-CAB) have jointly organized the press conference at BASIS Auditorium in Dhaka.

BASIS President Russell T. Ahmed, BACCO President Wahid Sharif, ISPAB President Md Emdadul Hoque and E-CAB Vice President Syeda Ambareen Reza were present at the press conference and gave their budget reaction on behalf of their respective associations and answered various budget related questions from the media representatives.

At the conference, BASIS President Russell T. Ahmed thanked Prime Minister Sheikh Hasina for extending the tax exemption for the ICT sector by three years. He stated, “This tax exemption will not only contribute to the development of the ICT sector but also play a crucial role in building Smart Bangladesh, impacting various fields such as education, healthcare, agriculture, banking, and export-oriented manufacturing. This is closely linked with the Fourth Industrial Revolution and will spur technological development and innovation across multiple sectors of a knowledge-based, cashless economy.”

BASIS President also pointed out that currently, only 10% of the $20 million cloud service and web hosting market is held by local entrepreneurs. He warned that bringing these services under taxation could discourage domestic entrepreneurs. He emphasized the need to keep cloud services and web hosting tax-exempt to support the growth of local ICT and service companies. He also called for the reconsideration of the imposition of a 1% import duty on capital equipment for high-tech park investors, urging the government to maintain the current duty-free status.

BACCO President Wahid Sharif highlighted that the tax exemption in the ICT sector would significantly contribute to technological advancement, innovation, and the creation of new entrepreneurs. He noted its positive impact on various export-oriented industries, education, healthcare, and banking, which would lead to job creation and substantial foreign currency earnings, thereby boosting the economy.

BACCO President also expressed concern about the removal of tax exemptions from sectors like cloud services, IT process outsourcing, medical transcription, search engine optimization, system integration, and NTTN services, which he warned could negatively impact the ICT industry. Additionally, he criticized the proposal to increase supplementary duty on mobile SIM card usage by 5%, which would raise the cost of mobile internet services. He stressed that expanding mobile internet and rural internet services is crucial for achieving Smart Bangladesh.

ISPAB President Md Emdadul Hoque expressed concerns regarding the proposed budget for the fiscal year 2024-25. Despite directives from the Prime Minister to enhance the ICT service sector, the failure to include all ISP services under the IT-enabled services (ITES) category, coupled with a 10% advance income tax (AIT) on broadband internet service providers and a 37% VAT and duty on ONU and OLT equipment, poses significant challenges. ISPAB believes these measures will hinder the expansion of internet services and the transition from Digital Bangladesh to Smart Bangladesh.

In a statement, ISPAB vehemently protested these regressive measures. The association called for the inclusion of all ISP services under ITES in the revised FY 2024-25 budget to ensure optimal internet usage and remove existing barriers. Additionally, ISPAB demanded the withdrawal of the 10% AIT on broadband providers, the 37% VAT and duty on ONU and OLT equipment, and all duties on ICT-related materials.

Syeda Ambareen Reza, Vice President of E-CAB, said that in the implementation of Smart Bangladesh, the existing benefits of IT and ITIS sector should be maintained and the supporting sector should also be developed because sometimes the growth of the main industry is hindered due to the support industry. One of the supporting sectors of the digital industry is website hosting and cloud services. Currently, this sector of the country is still dependent on foreign services. Tax exemptions will play a very important role in the coming years to ensure competitive prices and services for the development of domestic services in this sector.

Another subsidiary and integrated sector is the logistics sector. The existing VAT in the logistics sector needs to be withdrawn to expand e-commerce and smart logistics services. Because this creates a price difference between the products and services sold online and the products and services of conventional stores. In this way, online product service entrepreneurs do not get a level playing field. Therefore, according to the proposal of e-cab, VAT is withdrawn in the case of companies that deliver their own goods and services. And companies that provide these services to third parties may incur a minimum VAT of 5%.

She further said, to encourage digital payments, we demand to provide a minimum two percent cash incentive equivalent to payment charges in this sector. As banks and financial institutions deduct the payment charges and the remaining amount is returned to the e-commerce and IT platforms, there is no scope for tax deduction at source. In this situation, it is a logical call to not include the payment gateway charges in the Non-TDS deduction list.